Since 1964, the San Antonio Area Foundation has served as a beacon of hope and a catalyst for positive change.

Despite the changes we’ve faced over the years, one thing has remained consistent: our commitment to enhancing the well-being and quality of life for all community members.

Every day, we work to close opportunity gaps for those who need it most through grants, programs, scholarships and training — and we couldn’t do it without dedicated supporters like you who share our vision.

To ensure your charitable gifts qualify for a charitable income tax deduction in the 2023 tax year, please keep these important dates in mind:

Checks:

Please remember our new permanent mailing address is 155 Concord Plaza Dr, Ste. 301, San Antonio, TX 78216.

Checks sent via the U.S. Postal Service to the Area Foundation must be postmarked on or before Saturday, December 30.

Checks sent via carriers such as FedEx, UPS and DHL must be received on or before Friday, December 29. The airway bill must also be dated on or before Friday, December 29.

Wire Transfers:

Contributions are tax deductible based on the day the assets arrive in our account. Wire or EFT transfers of cash must be received no later than Friday, December 29. We recommend initiating the transfer no later than Friday, December 22. You may use our new online form to receive transfer instructions.

Online:

Credit card donations receive deductions based on the date the card was charged, so you may give online until 11:59pm (CST) on Sunday, December 31. Our donation page is able to receive credit card contributions for any fund of the San Antonio Area Foundation.

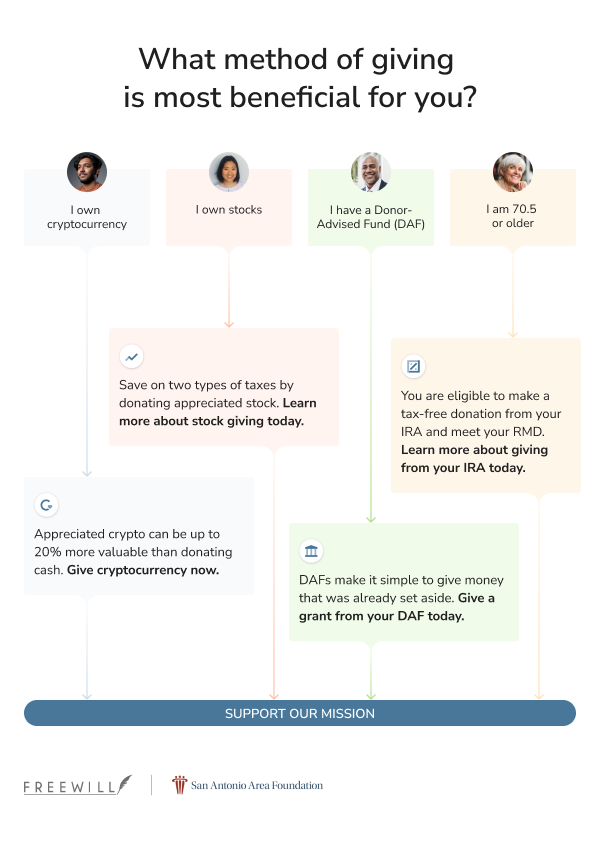

We have ambitious goals as we look ahead, and we want to share some smart ways you can further your impact while keeping your personal finances in mind. Gifts from Donor-Advised Funds, IRAs, cryptocurrency and stock portfolios can help your contribution to the San Antonio Area Foundation go even further— and save you money in the process.

Donor-Advised Fund Grants:

One powerful way to give smartly is through Donor-Advised Fund (DAF) grants. If you have a DAF, you may recommend a grant to the San Antonio Area Foundation, allowing us to direct your gift to the organizations and initiatives that align with your philanthropic goals.

By leveraging your DAF, you can make a difference in our community while enjoying immediate tax benefits and the flexibility to support multiple causes over time. It’s a win-win for you and the organizations you care about.

- If you have a DAF through San Antonio Area Foundation, you may enter a grant to San Antonio Area Foundation directly through our donor portal by using the drop down menu called “Other Foundation Funds” on the Grant Recommendations tab.

- If you have a DAF through a provider other than San Antonio Area Foundation, you may enter a grant to San Antonio Area Foundation using the FreeWill Smart Giving tool.

Stock and Mutual Fund Gifts:

Did you know that donating appreciated stocks can be a tax-smart way to give? By gifting securities, you can avoid capital gains taxes on the appreciation and receive a charitable deduction for the full market value of the stock. This means you can maximize your impact while minimizing your tax liability. Your stock gift can support vital programs and initiatives, creating lasting change in our community.

We are working with FreeWill, a new partner to help us receive donations of stocks and mutual funds in an easier and faster way. To donate stock and securities, you can securely initiate the transfer here.

Gifts from an IRA:

If you are 70 and a half years or older and have an Individual Retirement Account (IRA), you have the opportunity to make a Qualified Charitable Distribution (QCD) count towards your Required Minimum Distribution.

These distributions allow you to donate directly from your IRA to the San Antonio Area Foundation, satisfying your required minimum distribution while reducing your taxable income. This tax-smart strategy empowers you to support the causes you care about most while enjoying potential tax advantages. It’s a meaningful way to make a difference while optimizing your retirement savings.

- If you would like to establish a named Charitable Fund at Area Foundation to transform your QCDs into annual grants to nonprofits of your choice, contact us! We can assist you though a Designated Fund.

- You may also use a QCD to directly support our San Antonio Forever Fund or any of our Impact Funds for community goals.

Begin your QCD through your IRA custodial account or by using the QCD Gift tool powered by FreeWill.

Complex Assets:

Assets such as real estate, closely held stock or restricted stock may require approval from our Board of Directors Executive Committee. Please initiate these donations as soon as possible.

Cryptocurrency:

Similarly, to donating stock, you can avoid the capital gains tax and potentially receive a federal tax deduction against your income tax for the gift’s full value. Even during times of market volatility, know that your assets can advance our goals.

Learn more about the benefits of smart giving and get started.

Thank you for your ongoing commitment to the San Antonio Area Foundation. If you have any questions about smart giving, please contact Laura Giacomoni, Executive Director for Development and Donor Services, at lgiacomoni@saafdn.org.

Year-End Office Hours

The San Antonio Area Foundation is ready to help you complete your year-end charitable giving, with our staff available to provide answers and process transactions.

Our offices will be closed Friday, December 22 and Monday, December 25 through Monday Jan. 1 but staff will be available remotely Tuesday, December 26 through Friday December 29 from 8:00am to 4:00pm. For those eager to meet the year-end giving deadline by dropping off checks, please reach out to Laura Giacomoni at 210.775.1762 to coordinate the details. Your generosity is the gift that keeps on giving!

Our hearts are with the Kerrville community following the devastating flooding.

Please consider making a donation to help our neighbors rebuild by clicking here.